All Categories

Featured

Table of Contents

Maintaining your designations approximately date can make sure that your annuity will be handled according to your wishes must you die unexpectedly. Besides an annual testimonial, significant life events can prompt annuity proprietors to take an additional appearance at their recipient selections. "Somebody may wish to update the beneficiary classification on their annuity if their life situations change, such as marrying or divorced, having children, or experiencing a fatality in the family," Mark Stewart, Certified Public Accountant at Step By Step Service, told To alter your beneficiary designation, you should reach out to the broker or representative who handles your contract or the annuity carrier itself.

Similar to any type of financial product, seeking the aid of a financial advisor can be helpful. A financial organizer can assist you with annuity management processes, including the methods for upgrading your contract's beneficiary. If no beneficiary is named, the payout of an annuity's survivor benefit goes to the estate of the annuity holder.

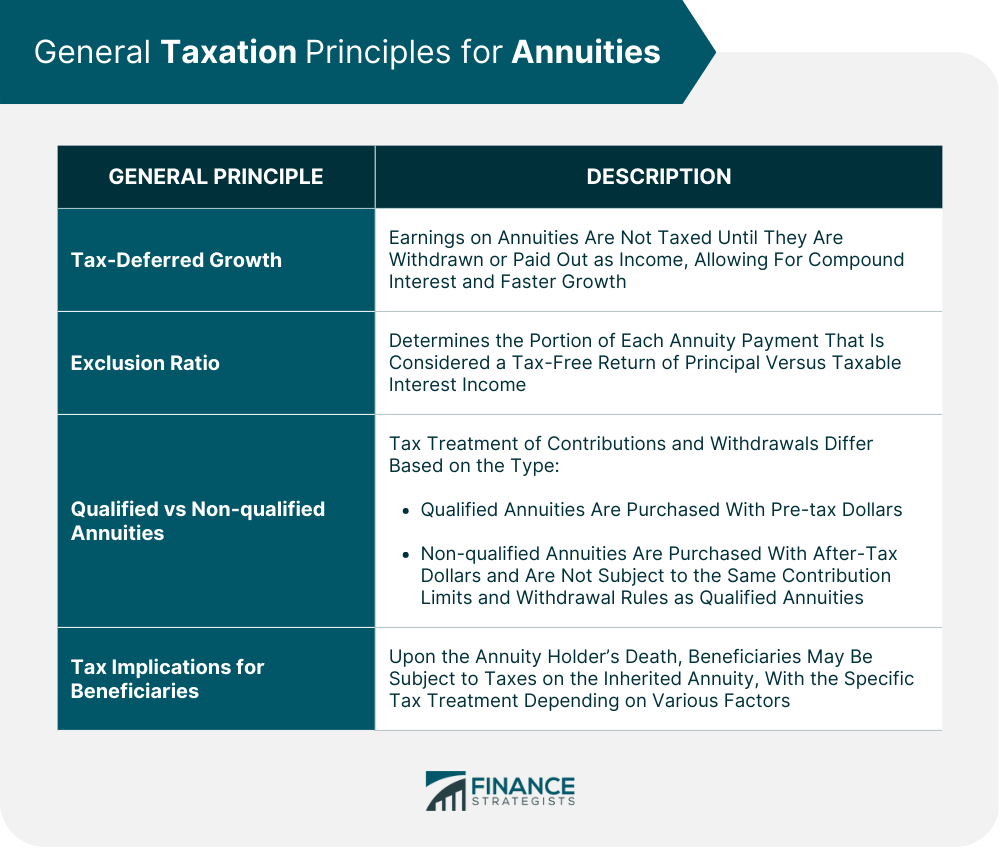

Inheriting an annuity can be an excellent windfall, however can likewise raise unexpected tax responsibilities and management concerns to manage. In this post we cover a few basics to be familiar with when you acquire an annuity. First, know that there are 2 kinds on annuities from a tax obligation point of view: Qualified, or non-qualified.

When you take cash out of an acquired qualified annuity, the full amount withdrawn will be counted as gross income and exhausted at your normal earnings tax obligation price, which can be fairly high depending on your economic circumstance. Non-qualified annuities were moneyed with financial savings that currently had actually tax obligations paid. You will not owe tax obligations on the original price basis (the total amount payments made initially into the annuity), but you will still owe tax obligations on the growth of the investments nevertheless which will certainly still be tired as income to you.

Particularly if the initial annuity owner had been receiving settlements from the insurance provider. Annuities are normally created to provide earnings for the initial annuity proprietor, and afterwards discontinue settlements when the original owner, and perhaps their spouse, have actually passed. Nevertheless, there are a couple of situations where an annuity might leave an advantage for the beneficiary acquiring the annuity: This suggests that the initial proprietor of the annuity was not receiving regular settlements from the annuity yet.

The beneficiaries will have several choices for how to receive their payout: They might keep the cash in the annuity, and have the properties transferred to an acquired annuity account (Long-term annuities). In this case the possessions may still stay spent and remain to grow, however there will certainly be called for withdrawal rules to be knowledgeable about

Taxes on Annuity Withdrawal Options inheritance

You may also be able to squander and receive a round figure payment from the acquired annuity. Be certain you recognize the tax effects of this choice, or talk with a monetary expert, since you might be subject to significant earnings tax obligation responsibility by making this political election. If you elect a lump-sum payout choice on a certified annuity, you will subject to income taxes on the whole worth of the annuity.

One more feature that might exist for annuities is a guaranteed fatality advantage (Annuity rates). If the original proprietor of the annuity elected this attribute, the beneficiary will certainly be eligible for an once lump sum benefit. Exactly how this is exhausted will depend on the kind of annuity and the value of the survivor benefit

The details regulations you need to adhere to depend on your partnership to the individual that passed away, the sort of annuity, and the phrasing in the annuity contract sometimes of purchase. You will certainly have a set period that you must withdrawal the possessions from the annuity after the first proprietors fatality.

Due to the fact that of the tax obligation consequences of withdrawals from annuities, this suggests you need to very carefully prepare on the finest way to withdraw from the account with the cheapest quantity in tax obligations paid. Taking a large lump sum may push you into very high tax obligation brackets and cause a bigger part of your inheritance going to pay the tax costs.

It is also vital to recognize that annuities can be traded. This is recognized as a 1035 exchange and permits you to move the money from a certified or non-qualified annuity into a different annuity with one more insurance provider. This can be an excellent alternative if the annuity contract you acquired has high costs, or is simply wrong for you.

Managing and investing an inheritance is unbelievably essential duty that you will certainly be compelled right into at the time of inheritance. That can leave you with a whole lot of questions, and a lot of possible to make pricey errors. We are right here to assist. Arnold and Mote Wealth Administration is a fiduciary, fee-only economic organizer.

Taxation of inherited Annuity Fees

Annuities are one of the lots of devices capitalists have for developing wealth and protecting their financial health. There are different types of annuities, each with its very own benefits and functions, the vital element of an annuity is that it pays either a series of repayments or a lump amount according to the agreement terms.

If you just recently inherited an annuity, you might not recognize where to begin. Annuity owner: The person who enters into and pays for the annuity contract is the owner.

An annuity may have co-owners, which is frequently the situation with partners. The proprietor and annuitant may be the same individual, such as when someone acquisitions an annuity (as the owner) to give them with a payment stream for their (the annuitant's) life.

Annuities with several annuitants are called joint-life annuities. As with several proprietors, joint-life annuities are a typical framework with pairs due to the fact that the annuity continues to pay the making it through spouse after the initial spouse passes.

It's possible you may get a survivor benefit as a recipient. However, that's not always the situation. When a fatality benefit is activated, payments might depend partly on whether the owner had actually currently started to get annuity payments. An inherited annuity survivor benefit functions in different ways if the annuitant wasn't currently getting annuity payments at the time of their passing away.

When the benefit is paid to you as a round figure, you get the entire amount in a single payment. If you elect to obtain a payment stream, you will have several choices offered, depending upon the contract. If the owner was already receiving annuity settlements at the time of fatality, then the annuity agreement may merely terminate.

Table of Contents

Latest Posts

Exploring Fixed Vs Variable Annuity Key Insights on Your Financial Future What Is Fixed Indexed Annuity Vs Market-variable Annuity? Advantages and Disadvantages of Different Retirement Plans Why What

Highlighting the Key Features of Long-Term Investments A Comprehensive Guide to Investment Choices Breaking Down the Basics of Investment Plans Features of Variable Annuity Vs Fixed Indexed Annuity Wh

Understanding Financial Strategies Everything You Need to Know About Variable Vs Fixed Annuity Defining Annuities Fixed Vs Variable Features of Fixed Indexed Annuity Vs Market-variable Annuity Why Cho

More

Latest Posts